how to calculate nh property tax

In new hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. New Hampshires real estate transfer tax is very straightforward.

Discount Kitchen Cabinets Portsmouth Nh Maine Me Boston Outlet Save 40 To 60 Portsmouth Nh Portsmouth Discount Kitchen Cabinets

To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the.

. Towns school districts and counties all set their own rates based on budgetary needs. Tax rates are expressed in mills with one mill equal to 1 of tax for every 1000 in assessed property value. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in.

Overview of New Hampshire Taxes New Hampshire is known as a low-tax state. In New Hampshire homeowners pay. NEW -- New Hampshire Real Estate Transfer Tax Calculator.

Determine the reasonable market value for your home using the assessed value. The tax is imposed on both the buyer and the seller at the rate of 75 per 100 of the price or consideration for the sale granting or transfer. Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated.

300000 x 015 4500 transfer tax total 2. To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Take the purchase price of the property and multiply by 15.

In new hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. In NH transfer tax is split in half by buyer and seller. The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev 800.

Our New Hampshire Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in New Hampshire and across the entire United States. The 2020 real estate tax rate for the town of stratham nh is 1895 per 1000 of your propertys assessed value. If you would like an estimate of the property tax owed please enter your property assessment in the field below.

2013 NH Tax Rates 2014 NH Tax Rates 2015 NH Tax Rates 2016 NH Tax Rates. You calculate property taxes according to multiplying the assessed value of your property by the mill levy a process that is used for the calculation of mill levies. Municipal local education state education county and village district if any.

But while the state has no personal income tax and no sales tax it has the fourth-highest property tax rates of any US. 2021 Taxes The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to. Heres how to find that number.

2021 New Hampshire Property Tax Rates. Property Tax Calculator - Estimate Any Homes Property Tax. The assessment ratio is the ratio of the home value as determined by an official appraisal usually completed by a county assessor and the value as determined by the market.

Click here for a map of New Hampshire property tax rates. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes. What Taxes Do You Pay In Nh.

So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. The 2021 tax rate is 1503 per thousand dollars of valuation. The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value.

There is however a 5 tax on dividends and interest. Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year. Please be aware that this estimate does not.

The 2020 tax rate is 1470 per thousand dollars of valuation. New Hampshires tax year runs from April 1 through March 31. By law the property tax bill must show the assessed value of the property along with the tax rates for each component of the tax.

Wages and salaries in New Hampshire are not subject to income tax. The assessed value multiplied by the real estate tax rate equals the real estate tax. NH Property Taxes also known as The Official New Hampshire Assessing Reference Manual.

The buyer cant deduct this transfer tax from their federal income tax but they can roll the amount into their new house cost basis. State with an average effective rate of 205. Enter your Assessed Property Value Calculate Tax.

Divide the total transfer tax by two. If you need to find out the exact property tax owed on. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

This states transfer tax is 075 of the sale paid by both buying and selling parties for a total aggregate of 15. To use the calculator just enter your propertys current market value such as a current appraisal or a recent. The RETT is a tax on the sale granting and transfer of real property or an interest in real property.

At that rate the property taxes on a home worth 200000 would be 4840 annually. This Manual is a product of the Assessing Standards Board manual sub-committee as authorized by the Assessing Standards Board ASB and its former and current Chairperson Betsey Patten. The 2019 tax rate is 1486 per thousand.

Taxes do not apply to sales in the state. The state and a number of local government authorities determine the tax rates in New Hampshire.

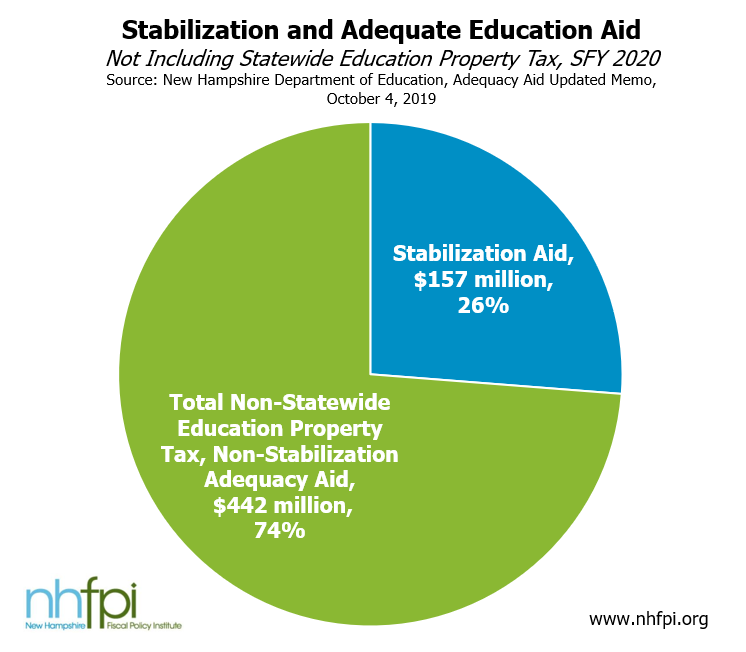

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Understanding New Hampshire Taxes Free State Project

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

Report School Funding Method Used Across N H Isn T Fair To Students Or Taxpayers

Chemistry291 Hand Note Znbr2 Compound Name What Is The Name Of Znbr2 Names Science Topics Chemical Formula

New Hampshire Property Tax Calculator Smartasset

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

City Launches Online Property Tax Calculator To Help Estimate New Tax Bill Manchester Ink Link

Monday Map Tax Increase From Fiscal Cliff For Median Four Person Family In Each State Fiscal State Tax Tax

The Ultimate Guide To New Hampshire Real Estate Taxes

Historical New Hampshire Tax Policy Information Ballotpedia

New Hampshire Covid Vaccine Rates By Town

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

New Hampshire Property Tax Calculator Smartasset

How To Calculate Transfer Tax In Nh

What Are The Various Appraisal Approaches Appraisal Insurance Sales Work Experience

Understanding New Hampshire Taxes Free State Project

New Hampshire Property Tax Calculator Smartasset

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh